R&D Tax Incentive: The bigger picture

The Research and Development Tax Incentive is one of the most significant changes for New Zealand businesses in recent times, encouraging more companies to conduct R&D.

It’s no secret that New Zealand’s spend on research and development lags behind many other OECD countries. The likes of Denmark, Japan, Korea and Israel’s R&D -to- GDP ratio exceeds 3%, while presently, New Zealand sits at 1.3%. And because innovation drives economic growth, this is somewhat of a problem for our economy.

To counter this and increase our R&D spend to 2% of GDP by 2027, the New Zealand Government launched the Research and Development Tax Incentive scheme on the 1st of April this year, a partnership between IRD and Callaghan Innovation.

This is excellent news for any NZ businesses who undertake R&D. In fact, we think this is the biggest change in the industry in many years. It’s not often we get this excited about tax! The new scheme breaks down hurdles that many New Zealand businesses with R&D programs face and promotes a structured (but not overly bureaucratic) approach to R&D and innovation.

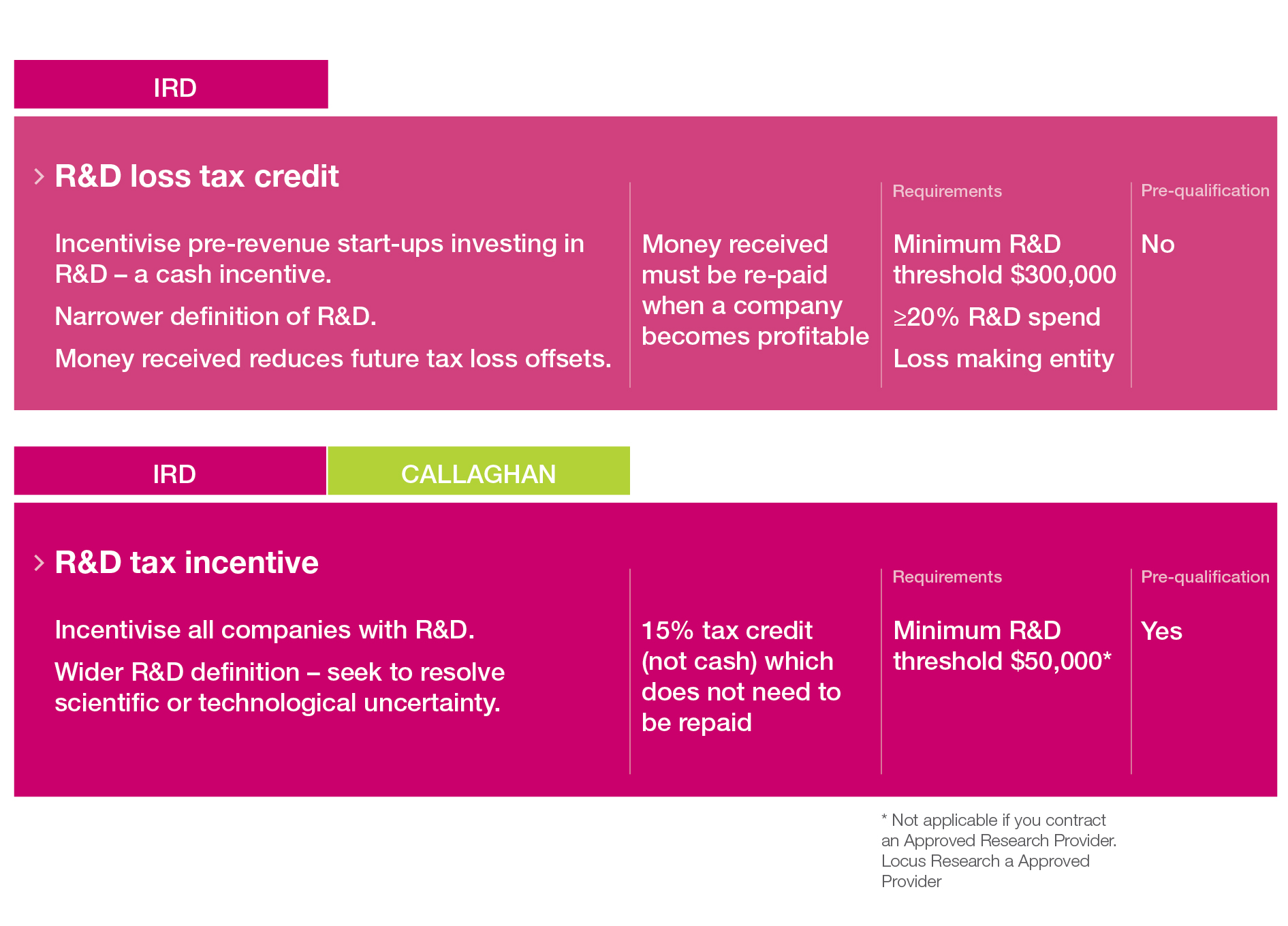

Under the new incentive scheme, if your business spends a minimum of $50,000 a year on R&D, you are eligible for a 15% tax credit. Even better, if you work with an Approved Research Provider like Locus, then the minimum threshold doesn’t apply. This opens up the tax incentive to many more New Zealand businesses that wouldn’t be eligible under other schemes.

Redefining R&D activity

One major change that this R&D Tax Incentive makes is that it redefines what R&D activities are. A core R&D activity must have the purpose of creating new knowledge, or new and improved processes, services and goods. It must also use a systematic approach which has the purpose of resolving scientific or technological uncertainty.

In a nutshell, if your business can show they’re exploring new ground, using a systematic approach, then your R&D activity should qualify for the rebate.

Better quality R&D

The collaboration between IRD and Callaghan is also designed to improve the quality of R&D programs and outcomes for NZ businesses. Working with an approved Research Provider is encouraged for this purpose as is the requirement to submit a research proposal for pre-approval.

See our R&D Essentials offer which explains the benefit of working with an R&D partner like Locus Research to provide assistance with research and assessment of your proposed project, a systematic plan and project reporting to meet the scheme’s application requirements, and even R&D resource to assist with or lead your R&D project.

The changing innovation landscape

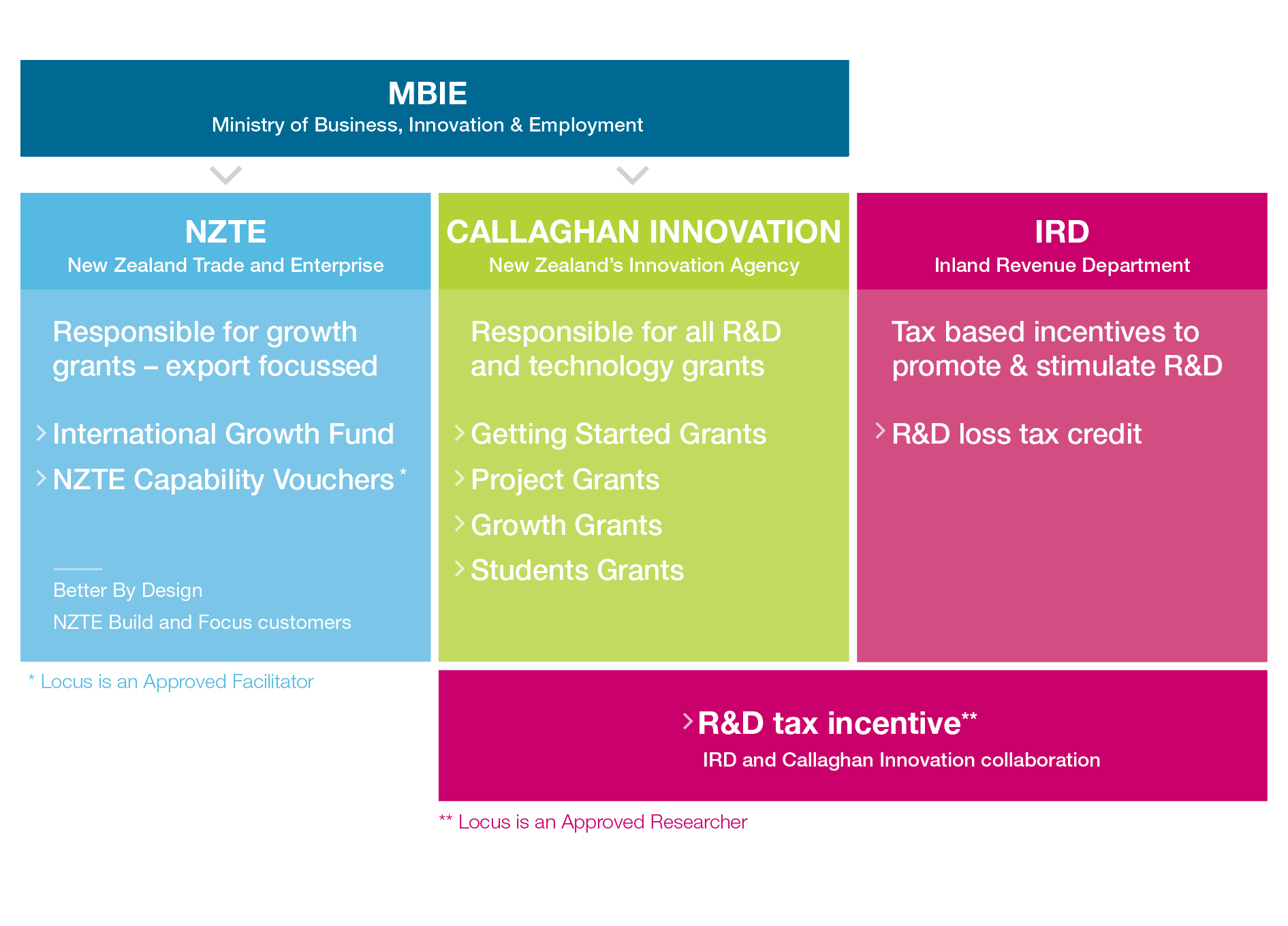

Wondering how this scheme fits in or replaces existing schemes? We’ve created a handy breakdown.

The R&D Tax Incentive is part of a wider package of government support for New Zealand’s innovation system. The tax incentive is in addition to the existing innovation support provided through MBIE and IRD but replaces the Callaghan Innovation Growth Grant, which will be phased out by the end of the 20-21 tax year.

The R&D Tax Incentive sees Callaghan Innovation collaborating with the IRD. Businesses must pre-qualify to take advantage of the tax incentive. This involves completing an application through the my IR portal, which will be assessed for general approval (from the 2021 income year).

Many start-ups already take advantage of the R&D Loss Tax Credit. This rebate gives companies access to their tax losses sooner, so they have cash on hand to help grow their business, ultimately it is however paid back with future tax on profits.

The new R&D Tax Incentive provides a non-repayable tax credit to businesses who undertake R&D. Pre-qualified businesses can claim a 15% tax credit on eligible R&D activities, which is theirs to keep and use as they please. If you are loss making or have more R&D tax credits than tax to pay, you may even qualify for a cash refund of your credits up to $255k in a year.

The good news is, start-up businesses can qualify for both schemes together. Loss-making companies engaged in R&D can claim an income tax loss refund (currently 28%) and the 15% R&D tax incentive credit on eligible R&D expenditure.

The criteria to be eligible for a refund relates to company structure and wage intensity and is the same for both schemes. The wage intensity criteria requires a minimum of 20% of your labour costs to be related to R&D. However, the R&D definitions and excluded activities differ. The R&D Loss Tax Credit still defines R&D in terms of the applicable accounting standards, whereas the R&D Tax Incentive defines R&D activities in terms of core and supporting R&D activities which seek to resolve scientific or technological uncertainty.

If you do not qualify for a refund of your tax credits in a given year, they will be carried forward to offset tax in future years.

Wondering whether your business might qualify for the tax incentive?

Our article, R&D Tax Incentive: In a nutshell gets down to the nitty-gritty of the scheme. Find out more about the requirements and how to get in on the action.

And if you’d like our help navigating this new territory, take a look at our R&D Essentials program, or get in touch.

Want to read more on creativity, design, product development and innovation? Go to our Six Lenses Blog.

Comments