R&D Essentials

The perfect start point to make sure your R&D is set up to succeed.

The R&D Tax incentive is designed to encourage R&D in New Zealand and effectively works as a subsidy.

Used adeptly, it can be a great tool to make your R&D efforts more financially achievable and ultimately more commercially viable. However, understanding whether you are eligible for the incentive might not always be straightforward.

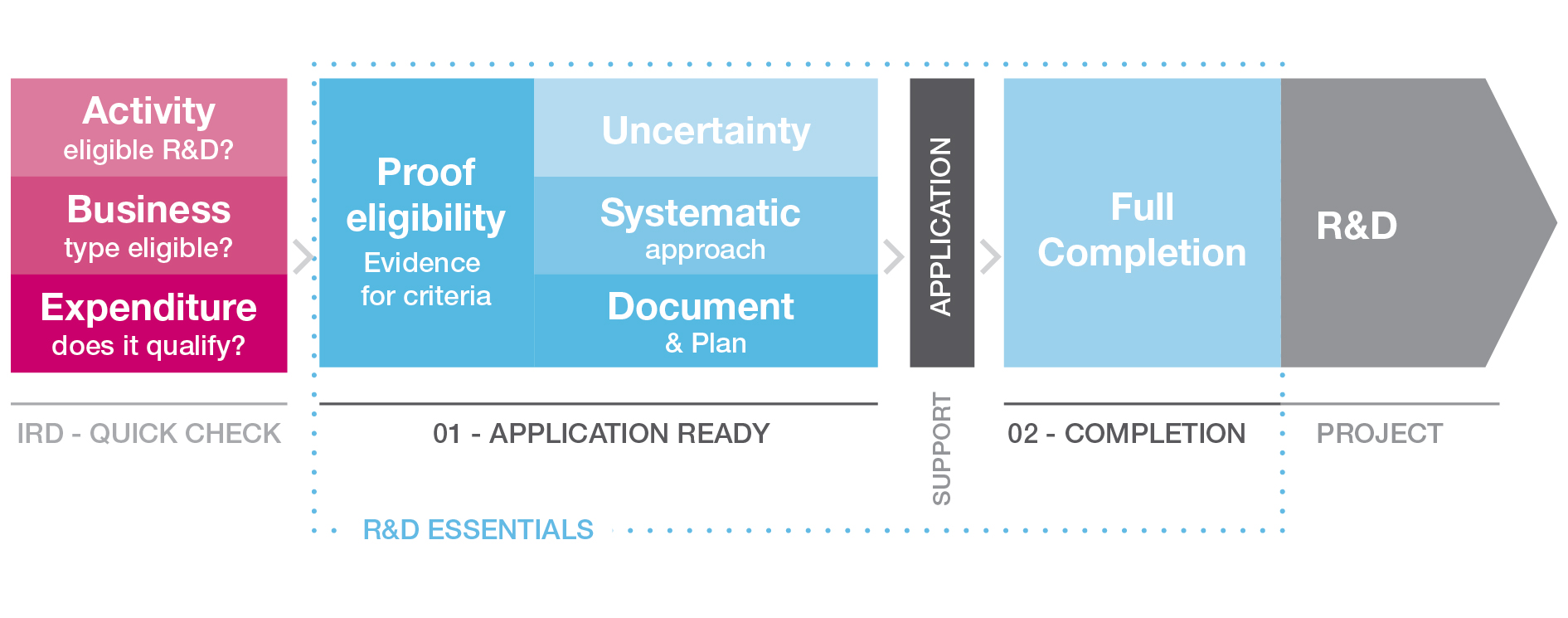

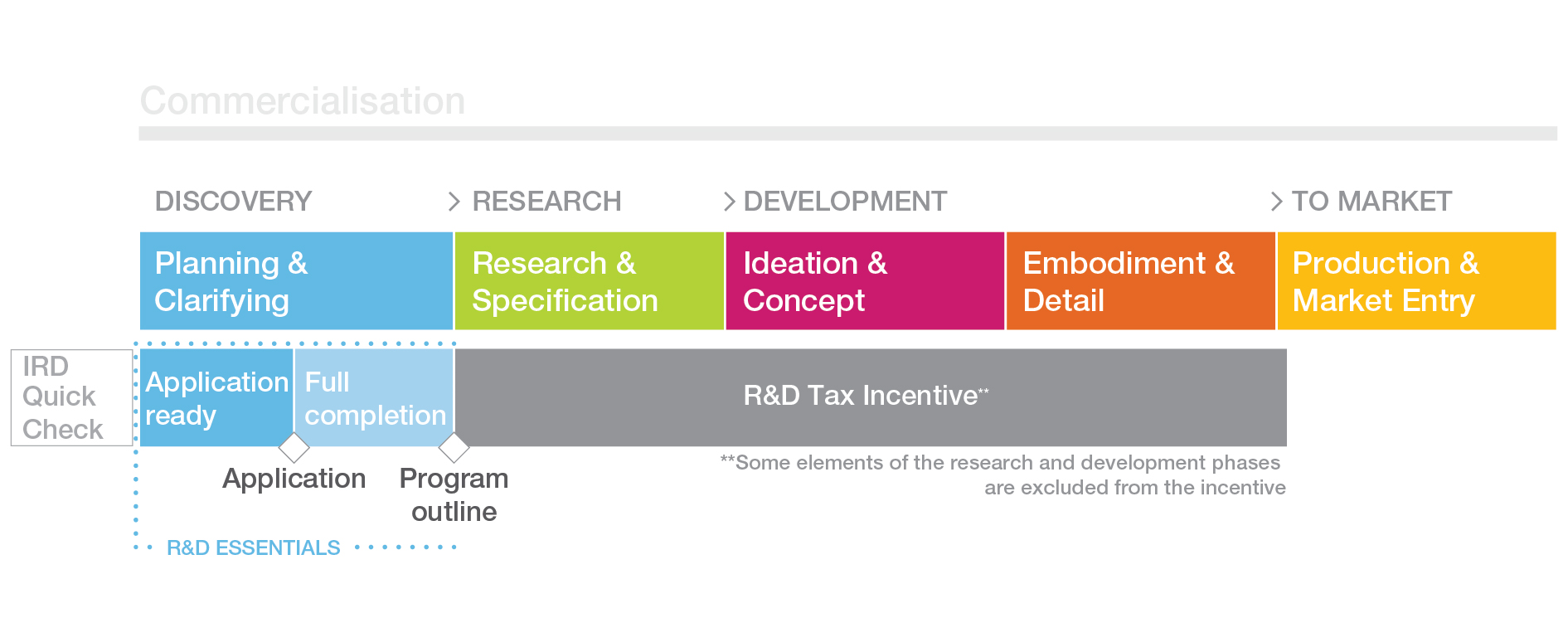

By using Locus as your research provider, we make it easier for you to ensure your business can take advantage of the new R&D Tax Incentive. We provide a two-part package that starts with an application readiness assessment, followed by the full R&D Essentials completion – which can lead to a more intensive wrap around service.

Our R&D Essentials program helps you navigate the landscape and answers questions needed to figure out which parts of your R&D project/efforts are eligible. It also doubles as an independent view. It’s the perfect place to start to ensure all your ‘ducks are in a row’.

From NZTE capability vouchers to Callaghan funding, from Angel networks to crowd funding — we have worked with them all, and can help you navigate the funding landscape. Get in touch to find out more.

The Program

As a base point, our R&D Essentials program will help you clarify whether the R&D you’re doing (or plan to do) would qualify for the tax incentive. And if not, what needs to be put in place in order to comply.

It addresses the key questions:

- Whether your core (and support) R&D activity has the purpose of creating new knowledge, or new and improved processes, services and goods.

- Whether you have a systematic approach with the purpose of resolving scientific or technological uncertainty.

Ideally, you would complete the full R&D Essentials program. We have separated Part 1 (below) for tax purposes. Provided you meet the tax incentive criteria, this work would be considered an R&D support activity, eligible for 15% credit. However, it only provides part of the picture. It does not include any commercial elements which are an important aspect of any R&D project’s feasibility.

Our full R&D Essentials program is designed to be a three-dimensional look into an idea or opportunity. The team looks at a wide array of influential factors through different lenses to establish the best pathway forward — the work results in a structured series of recommendations about your R&D activity.

Part 01

R&D Essentials

As a first step we will explore the following with you:

- Fully understand the idea – does the idea create new knowledge or new or improved processes, services or goods

- Use this gained knowledge to assess whether the idea is uncertain

- What research is out there?

- Is there any existing IP?

- Are there any similar technological developments?

- Are there any experts who could easily solve this problem?

- High level review your R&D practices.

- Is there a systematic approach?

- Outline any missing gaps – a pathway to application completion

- High-level R&D roadmap for your R&D project(s)

- Recommendations (including any insights outside of application requirements)

Doing this work up front serves two purposes. It positions your business to take full advantage of the R&D Tax Incentive, but more importantly, it helps set up your project(s) for success. Our team has a wealth of experience in R&D across multiple fields. We help businesses like yours unlock new thinking and ideas and bring these to market via a structured approach every day of the week. It’s what we do.

Enrolment + Application

If the assessment is positive, from the 2021 income year, you will need to enroll with IRD and apply for General Approval before you file your income tax return and R&D supplementary return.

For the 2020 income year only, the approval process occurs after your tax return is filed (i.e you will not have pre-approval certainty)

Part 02

R&D Essentials: Full completion

Answering the questions relevant to your tax incentive eligibility is only the first step. It does not take all factors that influence success into consideration. Our Essentials program complements and completes the initial work by extending the assessment and looking at areas that will inform the legitimacy of your projects from a commercial standpoint like: product landscape, competitors, commercial considerations, consumer preferences etc.

Our R&D Essentials service will help you develop a comprehensive understanding of where to put in time, effort, and money with a laser focus on bringing your new idea/technology to the market for commercial success.

Timing of General Approval (2021 income year onwards)

You can apply for General Approval after we have completed the Application Ready step. The earlier, the better in terms of having approval certainty before you start spending more R&D dollars.

However, you must have a reasonable degree of certainty around your project scope and process when you file your application. Because, if there are material changes afterwards, you will have to apply for an amendment to your approved R&D project.

Depending on the complexity of your project, we may advise you to finish the full R&D Essentials program before your approval submission. It will help create more certainty around your R&D program. In our experience, a broader commercial lense will inform your intended R&D project and could lead to necessary tweaks and changes.

Investing in your future

R&D Essentials is a targeted review and guide at the outset of a project, prior to embarking on any structural research or development activity. As such, we work at a fixed-cost base. We do what it takes to get you ready for enrolment and to get your R&D set up for success. We will flag any constraining findings as early as possible and push the pause button if we feel that they will be a showstopper.

What next?

After completing the R&D Essentials work you will have everything you need to complete the enrollment requirements.

Research & Development

After completing our Discovery program, we are in an excellent position to develop and implement a program outline to help you bring your product/service to life. Our support can range from pure project planning to full project implementation and beyond into commercialisation. We advocate a holistic approach and will include all efforts/work needed to bring your idea to life. Learn more about our research and development capability.

Innovation consulting

R&D success knows many enablers and blockers. A great idea alone is certainly not enough. We can work with you to build the potential of your team and to help you deliver better results through your own R&D programmes. This includes advice on innovation, commercialisation, and capability development through audit, review, and advisory services. Learn more.

R&D structure support

The support we provide can also lie in helping you further develop and optimise your R&D practices. Either to ensure eligibility for the R&D Tax Incentive or simply to get the best out of your R&D efforts.