R&D Tax Incentive: In a nutshell

Cutting through the 122 pages of the R&D Tax Incentive booklet can be daunting. So we’ve done all the leg work and have the scoop on the new R&D Tax Incentive.

At its core, the R&D Tax Incentive has been created to promote and increase New Zealand’s spend on R&D. This is an excellent initiative that not only helps all New Zealand businesses that conduct R&D programs but eliminates the barriers that some of those businesses face.

Want to know how much you could save?

If you just want to know whether it’s worth investing time to ensure pre-approval for this tax incentive, skip straight to our calculations (spoiler alert – it is worth it!). Otherwise read on for the low down.

The basic low down

Getting to the nitty-gritty of the R&D Tax Incentive, there are a few key takeaways that are important for any New Zealand business to know. Here are the basics:

- The R&D Tax Incentive is a 15% tax credit on R&D spend

- The minimum R&D expenditure is $50,000 but if you work with an Approved Research Provider (like us) the minimum threshold doesn’t apply

- The maximum amount of expenditure eligible for tax credit is $120 million

- Approval against eligibility criteria will occur as part of the tax return for the current year

- But pre-approval will be required from the April 2020 financial year onward

- Multi-year approval can be applied for up to three years at a time

As well as covering core R&D activities, the incentive also includes supporting activities associated with your R&D. These are the activities directly related to and required to conduct the core R&D activities. Examples include research to determine if there is an existing solution, work done to formulate your idea so that it can be tested, designing testing equipment etc.

Yes, we’re excited about tax

One of the biggest game changer’s is the definition of research and development. The definition has been redefined and widened from just focusing on scientific research. Under this new scheme, R&D activities are defined as solving scientific and technical uncertainty using a systematic approach.

This new definition opens the door to many businesses conducting R&D. It ensures the R&D Tax Incentive is accessed more easily across all sectors and available to a more significant number of New Zealand businesses that previously had no support.

As well as covering core R&D activities, the incentive also includes supporting activities associated with your R&D. These are the activities directly related to and required to conduct the core R&D activities. Examples are researched to determine if there is an existing solution, work done to formulate your idea so that it can be tested, designing testing equipment etc.

The R&D Tax Incentive requires pre-approval before you are eligible to claim your rebate. The addition of this step is to improve the quality of R&D projects while giving you the certainty of approval before you start your R&D journey (and spending money).

And finally, this R&D Tax Incentive’s minimum R&D expenditure is far lower than other schemes. In previous schemes, a business would have to spend $300,000 minimum to qualify, whereas the minimum R&D expenditure for the new R&D Tax Incentive is just $50,000.

This $50,000 minimum R&D expenditure gets better though. If a business uses an IRD Approved Research Provider like us, then this threshold does not apply. This opens the door for smaller businesses who conduct R&D to receive a kickback and afford to source resources to assist their endeavors.

Some examples of how the incentive could look for your business

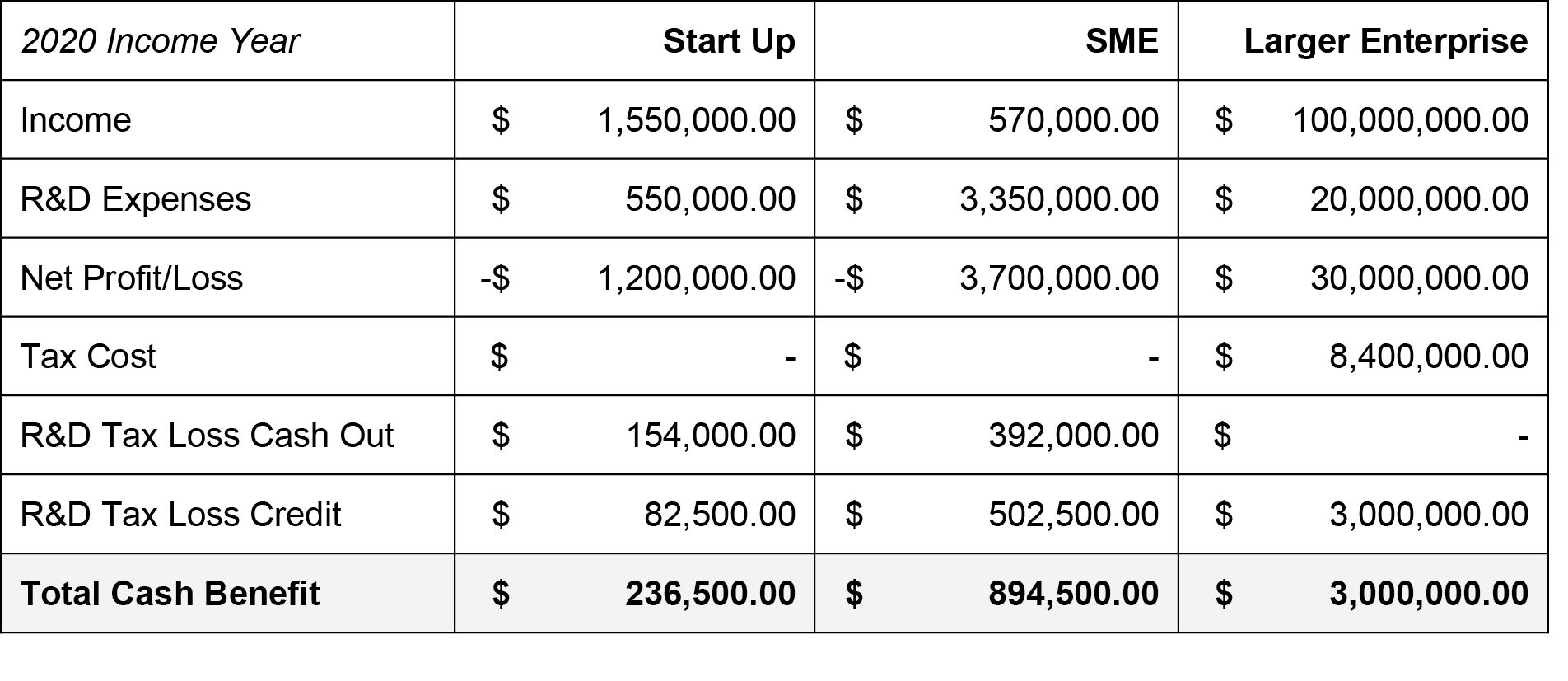

It all sounds good in theory, but we wondered what the numbers would actually look like. So we asked our friends at Findex to put some scenarios together for us and run the numbers. How could the tax incentive benefit a start-up business, and how would that compare to a larger enterprise?

Well, the numbers confirm it’s worth investing time to ensure pre-approval for this tax incentive. There are some significant savings to be had. (Noting that these are high level examples only and you would need to run the numbers for your unique business.)

Assumptions:

- Current rules apply for the 2020 income year

- All R&D activities and expenses meet the requirements of both the R&D Tax Loss Cash Out criteria and the R&D Tax Credit.

Eligibility process

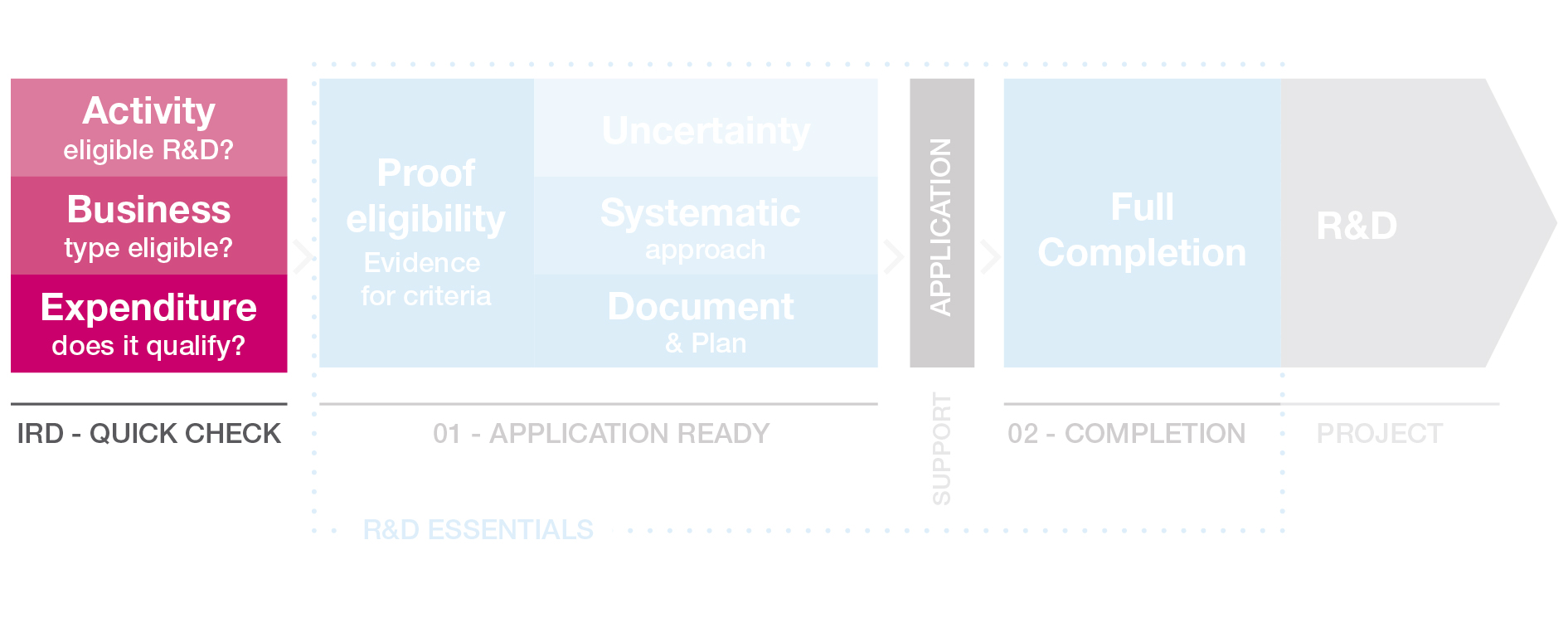

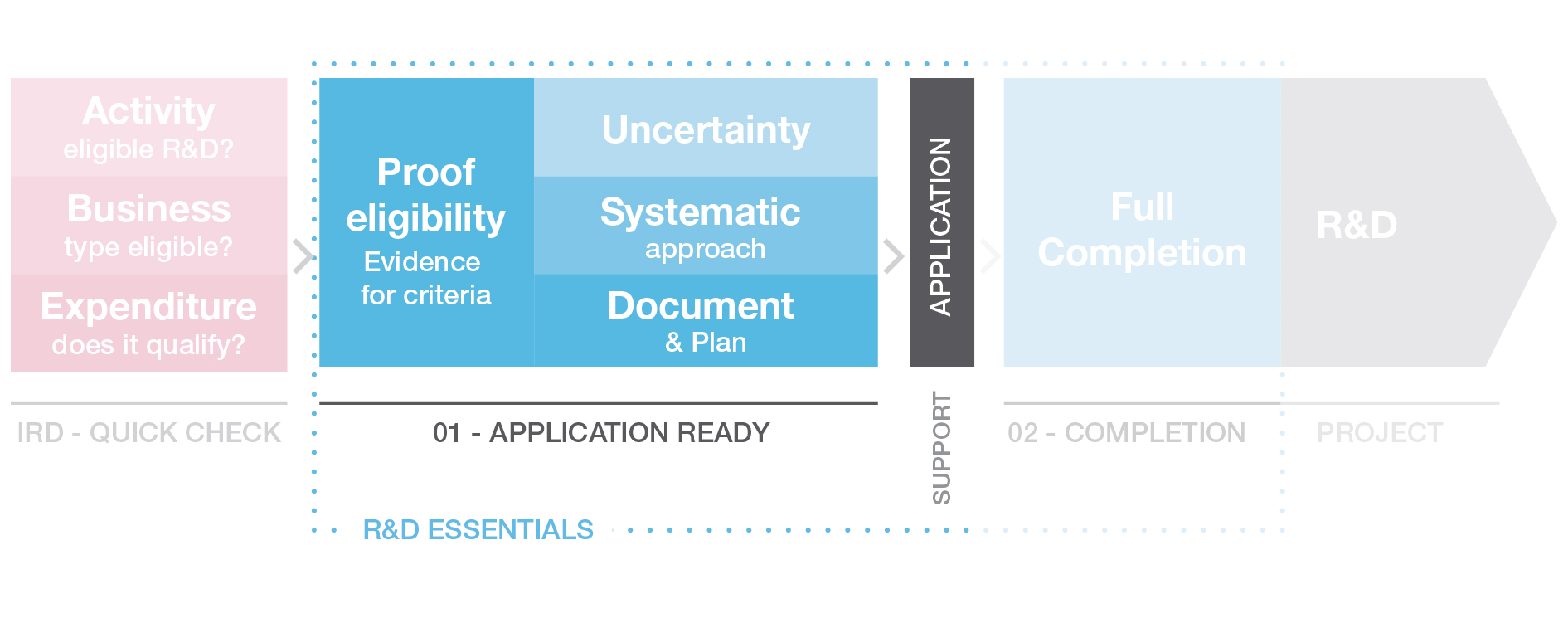

Quick check:

The IRD has released a handy R&D Tax Incentive eligibility tool that can start you on the process of finding out if you are likely to qualify for the tax incentive.

This tool takes you through a three-step process that will determinate if you are likely to be eligible or not. It does not however test your actual project content/uncertainty which can only occur at the general approval stage.

If it looks as though you are eligible, the IRD will recommend that you either consult their guidance material, contact the IRD directly or consult an adviser to assist with the next stage – applying for general approval.

Even if it looks like you might not be eligible, we may still be able to help. We can provide research and insights into your business/project and recommend a systematic approach for your project.

General approval:

Locus Research can provide you with the necessary research, reporting and resources to seek approval as well as providing the documentation your accountant will require.

For approval you need to show that your business is exploring new ground using a systematic approach.

You will need a tax adviser to process your end of year R&D Tax Incentive (filed with your Income Tax Return),

It is essential to have a good R&D plan that shows the intent of the project as well as the systematic approach that you will be taking. To take full advantage of this tax credit, your plan must outline your systematic approach to test (analyse, prototype, or experiment with) possible solutions(s) to an uncertainty.

*For the 2019/20 year this won’t be required until claim time, but from 1st April 2020 forward this will need to be lodged in advance (when the full scheme kicks in for 2021).

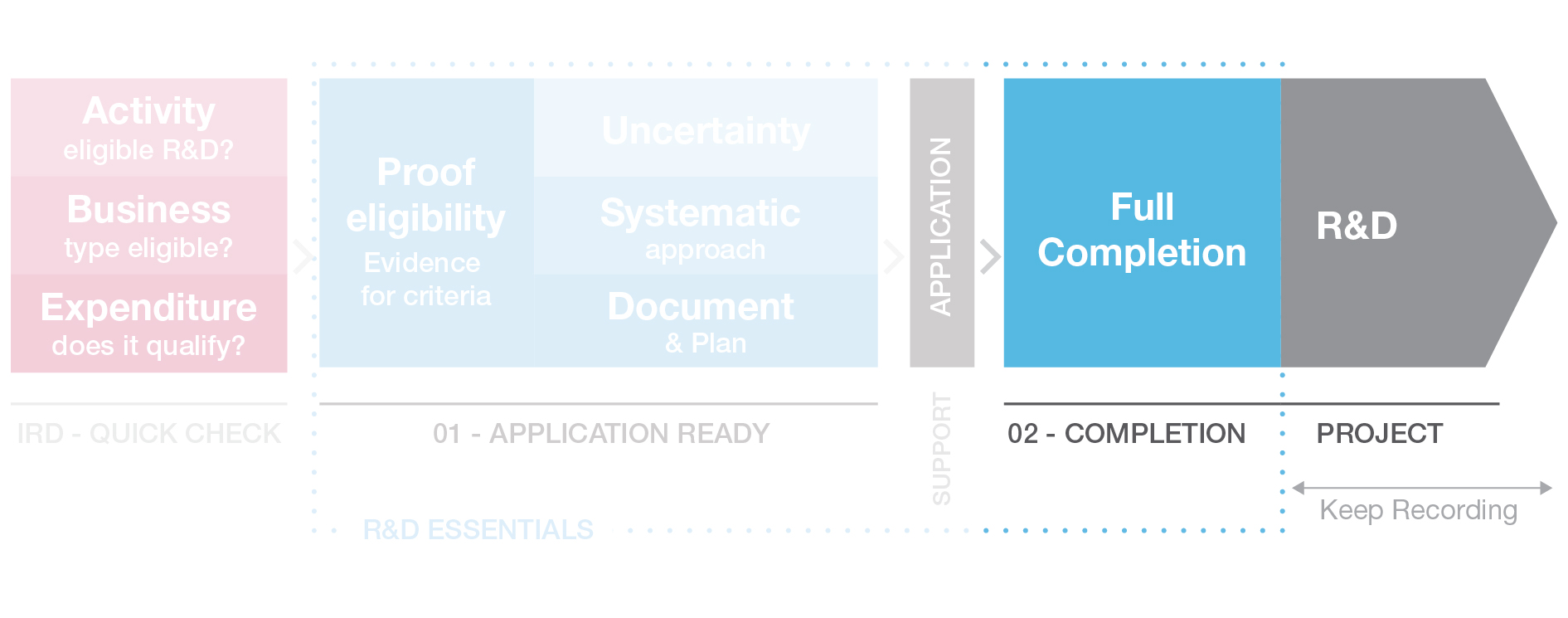

You’re pre-approved. Keep recording.

Being pre-approved isn’t the end of the story. During your R&D project you will need to keep a good track record – to convert the pre-approval into a compliant claim with successful R&D activities.

After pre-approval, the lion share of the work involved in claiming your tax credit will lie with your accountant. There are some essential general record keeping requirements they will need. Records need to be available to support that:

- the R&D activity is eligible and within the scope of the approved project

- your R&D expenditure, core and support is eligible.

If you comply with the criteria, this is what you’ll need to show:

1. Contemporaneous records

Your standard project documentation should be used as much as possible to capture the required information.

Progress must be recorded throughout the year (not at the last minute). This includes project scope and cost as well as results, risks and increasing knowledge.

2. Report on your progress

- Regular reporting on the R&D program

- Track to key milestones and outcomes

You will need to have great record keeping. All process must be recorded throughout the year and not done haphazardly at the last minute; this also includes project scope and cost as well as results, risks and increasing knowledge.

Best practice is to be regularly reporting on the R&D program with clear milestones and decision stage-gates. This is where working with us can really help. As experienced R&D practitioners we can do what it takes to get you ready for enrolment and, more importantly, get your R&D set up and operating for success.

Need some help?

We know this can be intimidating but we are here to help, take a look at our R&D Essentials program, or get in touch.

Want to read more on creativity, design, product development and innovation? Go to our Six Lenses Blog.

Comments