Turning Innovation into Gold: Attracting investment

We recently attended a seminar put on by James & Wells titled ‘Turning Innovation into Gold’. This seminar aimed to shed some light on the different funding options available to help businesses grow, the advantages of each, and what they look for in a potential investment.

A range of funding options was represented at different levels including government-supported funding (WNT Ventures), equity crowdfunding (Snowball Effect), private equity (Oriens Capital), and debt funding (ANZ).

Alongside these funding organisations, NZTE was there to talk about their services in helping to grow your business internationally. Their website features Investment Showcases where they connect businesses with investors. NZTE have 45 people in their capital team and half of these are based offshore. They will work with any exporter with global potential and have an array of ways in which to assist from orientation, readiness, and connectedness.

James & Wells talked about the importance of IP (investors are looking for a strong IP strategy) and UBCO put it all into context giving a practical example by sharing their story in securing investment throughout the different stages of their young but promising existence.

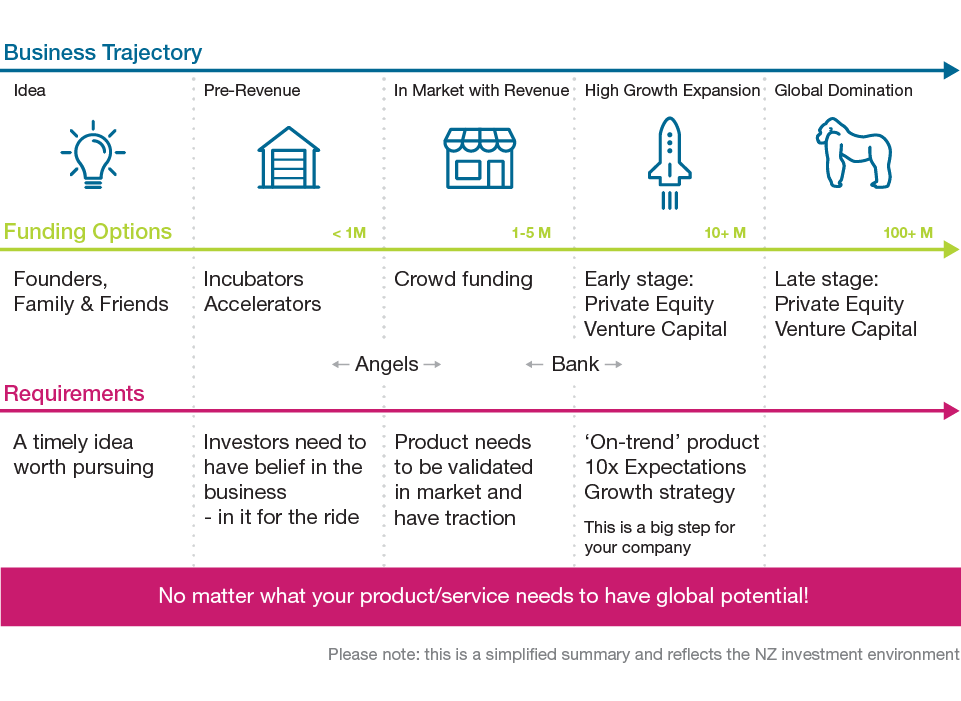

We’ve put together a quick summary of the different types of investment and how they fit in with a business’s trajectory:

After listening to all speakers we walked away with some main themes and key takeaways:

Risk Profiles & Types of Investors

Every stage of business development, if it meets the right criteria, has a potential funding avenue. However, the seed stage or early investment options are still challenging and limited. The risk profile changes the further downstream you go. Early investors are perhaps more in it for the ride; they want to feel a part of the business and are happy to take a bit more risk. This changes as you move into the private equity and venture capital space, where traction is everything, expectations are 10 fold, and risk needs to be limited. These bigger capital injections will also lead to big changes in your company, so it’s a step not to be taken lightly. Banks are another platform altogether. This is a relatively low-cost source of funding, but the main objective is loan repayment within a reasonable time period.

It is important to understand the different types of investors you might be dealing with along the way and understand what they are after in terms of risk profile as well as how they can contribute.

Teamwork:

Expect and look for more than just money:

A lot of investors and organisations come with a wealth of knowledge and a great network. They are just as valuable as the dollars that come through the door. The partnership goes both ways; the investor expects a strong story (vision), a strategy with a realistic timeline, and a great team aligned across the board. You can expect engagement, extensive knowledge, guidance and a strong network.

Ensure alignment on multiple levels:

What are your shareholders’ objectives? You’ll need to understand their goals and timelines. What are your business objectives? Are you capable of achieving this, do you need external help (governance), and what is your long-term plan?

And more importantly, are your business and shareholder objectives aligned? An aligned team and a clear story are key. You get one chance to make an impression on potential investors. Don’t muddy the waters with an unclear story.

“A great idea can be killed by a poor team, and a mediocre idea can be turned into gold by a strong team”.

Please note that we are not promoting mediocre ideas here 😉

Go Global — there is no “easy” market

No matter what, think global. A company’s real potential usually lies outside our borders and investors want to see a global strategy. An interesting observation by the panel was that NZ companies tend to diversify too early to get more revenue out of NZ, which more often than not is the ‘test’ market. This leads them to water down their proposition before they go international. A strong, more niche approach can drive a large worldwide proposition. This proposition will also allow you to stick to your knitting, truly assess the global potential, and protect it if needed. Markets can be lost because a global view hasn’t been taken with IP strategy.

Finance — the importance of strong financial management.

A very common theme across of the presenters, and also something we see at Locus, was entrepreneurs not getting good professional support on finance. This isn’t just a weak spot for start-ups, either. Understandably, entrepreneurs that don’t have a finance background don’t know what they don’t know. This often leads to lack of priority given to finance or the wrong type of resource applied to it.

There is quite a difference between financial management versus accounting and financial reporting for compliance. Many organisations don’t know what good looks like in terms of financial management, especially in an early stage business. This is even true of existing businesses that are new to commercialising new products or other innovation.

Don’t underestimate the importance and value of having an experienced financial resource in your organisation.

Intellectual Property — a strategic approach

The best place to start is with an IP strategy review, which will help set priorities, timelines, and expected costs. Investors are looking for a combination of IP, a good understanding of your market, your potential to scale up, and a capable team. IP can come in many shapes and forms, including patents, design registrations, trademarks, trade secrets, and processes. Timing is a key piece of the puzzle, so make sure that you constantly step back to assess your product against the market. Allowing for room to pivot and keeping an eye on the global market, especially in the early days, can be a stepping stone to success.

Watch out for our Applied IP workshops coming soon.

Thanks to James & Wells for putting on this event. It reaffirmed many of our current beliefs here at Locus:

- The team of people behind an organisation is almost as important as the products themselves.

- Attracting investment is not just about the money, it’s about building the right team.

- Invest in the right support on legal, finance, and structure. It will pay off, so be sure to allocate a proportion of your capital to this.

- A clear compelling story is key. Have your elevator pitch and concise slide deck prepared. Make sure your full team share understanding and share the story.

- Think global from the beginning.

Locus Research is a product development and innovation consulting agency. We have a cross-disciplined team including our very own financial wiz who can assist you with the pointy end of your innovation project or journey, from financial planning and modelling for investment proposals, to hands-on involvement in your project or executive support. Let us show you what good looks like.

Want to read more on creativity, design, product development and innovation? Go to our Six Lenses Blog.

Comments